BENEFICIAL OWNERSHIP

INFORMATION REPORT (BOIR)

New 2024 Federal Regulatory Business Requirement (BOI)

(31 U.S.C. 5336 and 31 C.F.R. 1010.380)

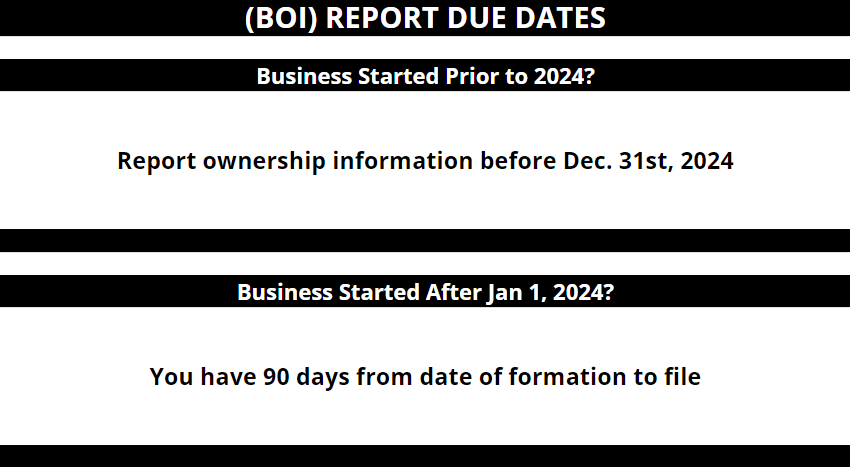

The U.S Department of the Treasury’s BOI report is a new business requirement mandated by FINCEN, the Department of the Treasury’s Financial Crimes Enforcement Network. BOI reporting obligations must be completed within your filing deadline. All deadlines will be based off the date of business formation.

Failure to complete the filing before the deadline may subject the company to a $500 per day fine, up to a maximum of $10,000. Intentionally filing incorrect information is punishable by up to two years in prison.