BENEFICIAL OWNERSHIP

INFORMATION REPORT (BOIR)

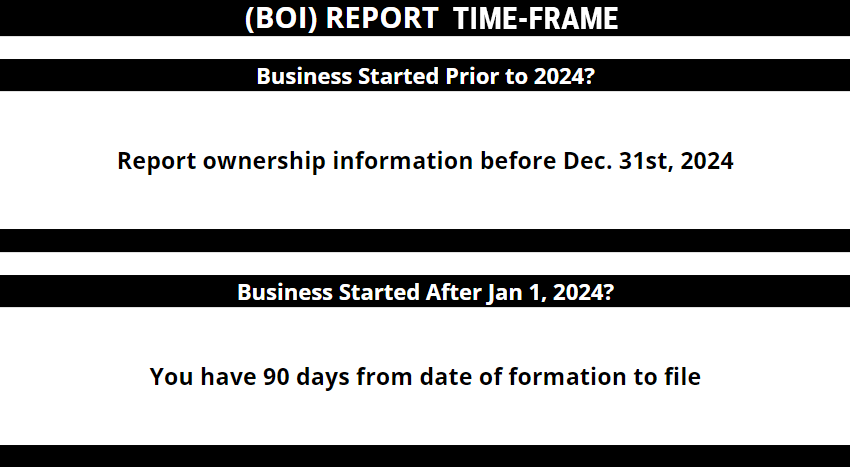

New 2024 Federal Regulatory Business Filing (BOI)

The U.S Department of the Treasury’s BOI report is a new business filing from FINCEN, the Department of the Treasury’s Financial Crimes Enforcement Network. BOI reporting obligations.